Summary:

As the monetary landscape evolves, investors seek out dynamic approaches to enhance their returns when taking care of possibility. Deal for Variance (CFD) buying and selling offers a compelling option to conventional stock investments, supplying distinctive advantages such as leverage, adaptability, and diversified current market entry. This text explores the many benefits of investing CFDs stocks when compared with owning actual shares, highlighting crucial concerns for investors wanting to boost their portfolio general performance.

Keyword phrases: CFD buying and selling, shares, leverage, overall flexibility, threat administration, market place accessibility, investment tactic

Introduction:

In today's speedy-paced fiscal markets, traders are continuously seeking impressive avenues to maximize their returns and mitigate danger. Agreement for Variation (CFD) trading has emerged as a popular decision, supplying a versatile and efficient way to invest on the worth movements of varied belongings, such as shares. This article delves to the distinctive benefits of trading CFDs stocks around conventional stock investments, giving valuable insights for traders trying to find to enhance their buying and selling procedures.

I. Comprehending CFDs Stocks:

one.one. Definition and System:

Trading CFDs stocks requires coming into into contracts with brokers to take a position on the price movements of underlying stocks with no proudly owning the particular shares. Instead, traders earnings or incur losses determined by the primary difference in the stock's price tag involving the deal's opening and shutting.

one.two. Leverage and Margin Investing:

Amongst the primary attractions of trading CFDs stocks is the ability to make use of leverage, enabling traders to control greater positions with a relatively tiny Preliminary investment decision. By buying and selling on margin, investors can amplify their prospective returns, although it's essential to physical exercise caution as leverage also magnifies losses.

II. Benefits of Trading CFDs Shares:

two.one. Versatility:

As opposed to standard stock investments, which need outright ownership of shares, investing CFDs shares presents unparalleled overall flexibility. Traders can take advantage of the two increasing and falling marketplaces by getting extended or brief positions, enabling them to capitalize on market opportunities despite current market route.

2.2. Diversified Sector Entry:

CFD buying and selling platforms provide usage of a broad selection of shares from world-wide markets, allowing traders to diversify their portfolios effectively. With CFDs, traders can certainly examine and capitalize on options throughout unique sectors and geographic regions, maximizing portfolio resilience and likely returns.

2.three. Reduce Entry Boundaries:

Buying and selling CFDs shares calls for considerably lessen money outlay in comparison with traditional inventory investments. With CFDs, buyers can trade fractional positions, enabling them to engage in high-priced shares with minimal Preliminary investment. This decrease entry barrier democratizes access to the fiscal marketplaces, attracting a broader demographic of investors.

two.four. Hedging and Threat Administration:

CFD trading presents robust chance administration resources, letting investors to hedge their positions and safeguard versus adverse marketplace actions. Prevent-loss orders, certain cease-losses, and Restrict orders are generally used to outline possibility parameters and minimize likely losses, maximizing overall portfolio balance.

two.five. Increased Liquidity:

CFD markets normally show superior liquidity, ensuring seamless execution of trades even for the duration of risky market circumstances. This liquidity allows traders to enter and exit positions promptly, capitalizing on fleeting market possibilities and optimizing buying and selling approaches.

III. Scenario Analyze: Evaluating CFDs Stocks with Conventional Stock Investments:

3.1. Expense Performance:

Traditional stock investments frequently entail further charges which include brokerage commissions, exchange charges, and stamp obligation taxes. In contrast, trading CFDs stocks normally incurs reduced transaction expenditures, rendering it a far more Price tag-effective option for active review traders.

3.two. Margin Prerequisites:

With CFD investing, buyers can trade on margin, enabling them to manage much larger positions that has a scaled-down First funds outlay. This leverage makes it possible for traders to amplify their likely returns, although it's essential to handle risk prudently to avoid margin phone calls and probable losses.

IV. Summary:

In summary, buying and selling traders review CFDs stocks provides a host of benefits in excess of standard stock investments, including adaptability, diversified current market accessibility, reduce entry barriers, strong chance management applications, and Improved liquidity. By leveraging these Rewards, investors can improve their buying and selling methods, trading improve returns, and navigate by dynamic industry circumstances with assurance. On the other hand, It really is essential for buyers to conduct complete investigation, adhere to prudent danger trading review administration methods, and seek Specialist guidance when important to guarantee effective CFD investing outcomes.

References:

[one] Investopedia. (n.d.). Agreement For Dissimilarities - CFD. Retrieved from https://www.investopedia.com/terms/c/cfd.asp

[2] IG. (n.d.). trading platform Exactly what are CFDs? Retrieved from https://www.ig.com/en/trading-strategies/what-are-cfds

[3] Saxo Marketplaces. (2022). Trading CFDs - A rookie’s manual to contracts for variance. Retrieved from https://www.home.saxo/en-sg/education/trading-skills/contract-for-difference/what-are-cfds

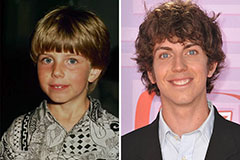

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Shane West Then & Now!

Shane West Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!